UK Escrow Services & Merchant Accounts

Money Transmitter & Credit Management

Project Financial Management

International Trade Finance Services

Bespoke Inter-Business (B2B) Services

Sterling-Bond Escrow Services - How It Works

The following illustrate the basic process for escrow transaction in three forms of business:-

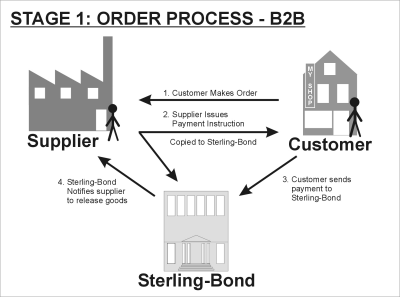

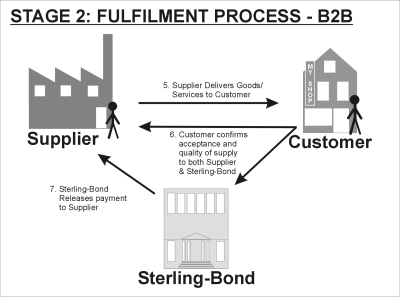

Inter-Business Transactions

FIG.1. EscrowSecure for inter-business (B2B) trade. Customer orders, supplier gives payment instruction (Invoice), instruction and payment goes to Sterling-Bond who notify supplier to release goods.

Fig.2. Escrow Secure of inter-business trade: Supplier delivers goods, customer inspects and approves, notifying supplier and Sterling-Bond. Sterling-Bond release payment to supplier. Otherwise process is reversed.

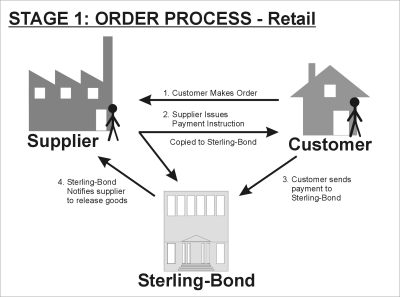

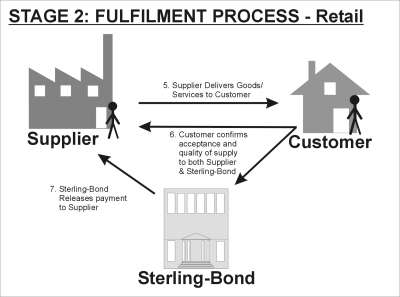

Retail Transactions, Business To Consumer

FIG.1. EscrowSecure merchant accounts for domestic/retail markets. Customer orders, supplier sends payment instruction (Invoice), payment & copy of instruction go to Sterling-Bond who notify supplier to release goods.

Fig.2. Supplier delivers goods, customer inspects & approves, notifying supplier and Sterling-Bond. Sterling-Bond release payment supplier. Otherwise process is reversed.

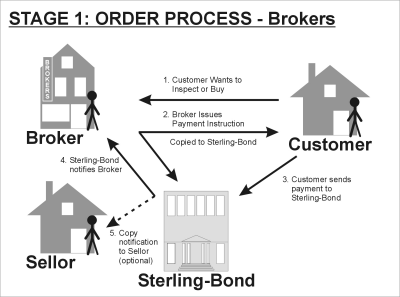

Intermediary/Brokerage Transactions

FIG.1. EscrowSecure merchant accounts for brokers. Customer orders, broker gives payment instruction (Invoice), instruction and payment goes to Sterling-Bond who notify broker to release goods.

Fig.2. Broker delivers goods, customer inspects and approves, notifying broker and Sterling-Bond. Sterling-Bond release percentage split payments to broker and seller. Otherwise process is reversed.

These are just three examples of conventional escrow transactins, more sophisticated services and specialist industries can benefit from Sterling-Bond escrow with variations of the above or additional features to be discussed with the you.

View to Screen

View to Screen View to Print

View to Print